- Female VC Lab

- Posts

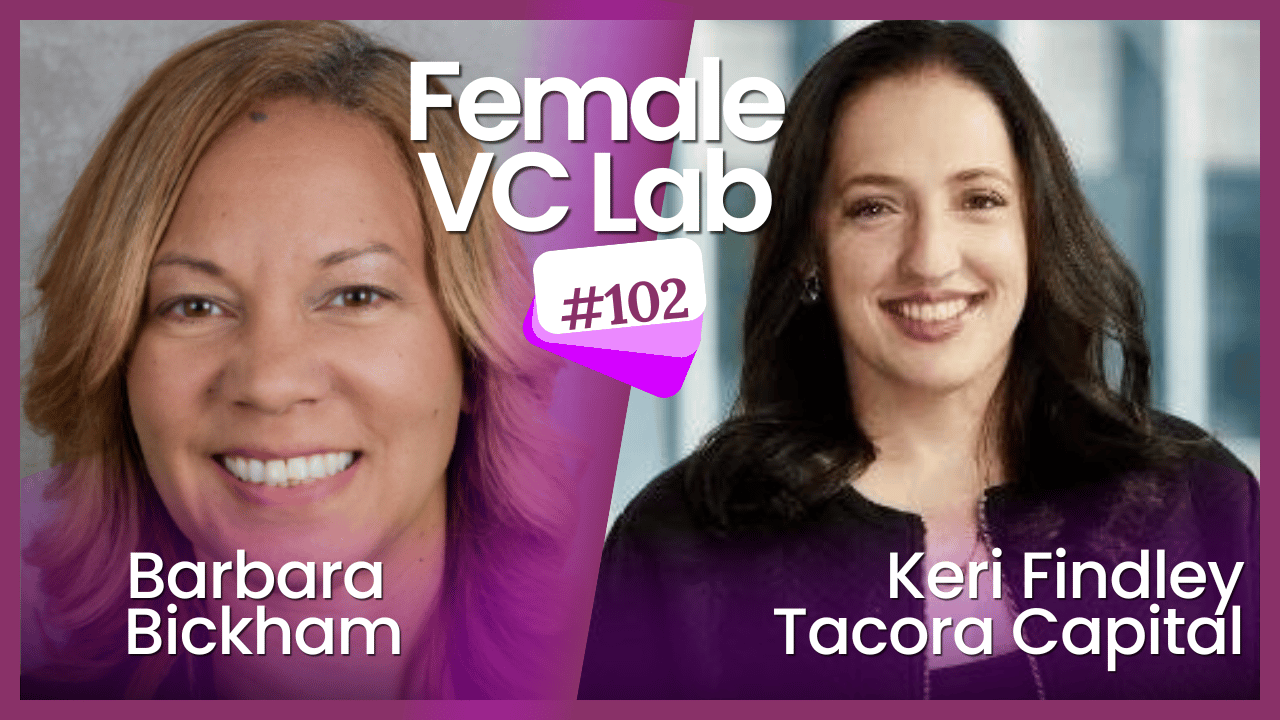

- Episode E102 - Keri Findley - Tacora Capital

Episode E102 - Keri Findley - Tacora Capital

Female VC Lab Podcast Episode 102

Hi Impactful listener!

In this episode of Female VC Lab, host Barbara Bickham sits down with Keri Findley, CEO and CIO of Tacora Capital. They dive into Keri's journey into the venture capital world, her investment thesis, and the evolving landscape of venture capital and debt financing. Keri shares her insights on why she believes venture-backed businesses need diverse financing options and her hope for the future of venture capital embracing asset-backed financing.

Key Points Discussed

Keri's inspiration to become a venture capitalist and her entry into the finance world.

Development and motivation behind Keri's investment thesis at Tekora Capital.

Current trends and future perspectives on venture capital and debt financing.

How asset-backed financing can be integrated into various industries.

Keri's current readings and the importance of continuous learning.

🎧 Watch the Episode

Chapters

00:00: Introduction and opening question

00:08: Keri Findley introduces herself and her role at Tekora Capital

00:19: Keri's journey into finance and venture capital

00:44: Explanation of Keri’s investment thesis and initial inspiration

02:06: Current trends and what Keri is reading or learning about

03:31: Future perspectives on venture capital's evolution

04:49: Discussion on asset-backed financing across various sectors

06:19: Conclusion and contact information

Full Topic Guide

A Journey Into Venture Capital: Keri Findley’s Path

From College Grad to CEO

Keri Findley’s venture into the finance world began during her college years at Columbia University. Keen on starting her professional journey, Keri applied extensively through the university's Career Center job board, eventually landing a role in ABS CDO Research. This early exposure sparked her love for finance, setting the stage for her to explore various roles within the industry and ultimately leading her to create a venture capital firm, Tacora Capital.

Crafting an Investment Thesis: The Tekora Capital Way

Inspiring Financial Innovations

Keri’s investment thesis stems from her encounter with SoFi in 2013, a pivotal moment that shaped her understanding of financial innovations. Witnessing SoFi’s initial struggle to secure financing despite a high-quality student loan portfolio, Keri identified a critical market gap. She realized that venture-backed businesses needed balance sheet capital to complement existing equity and debt financing. This insight drove her to create unique financial products tailored to these needs, paving the way for Tacora Capital to support diverse entrepreneurial ventures.

The Evolving Landscape of Venture Capital

Embracing Debt Financing

During the discussion, Keri expressed her hope that venture capitalists would become more comfortable with incorporating debt into their portfolios. Historically, many VCs viewed debt as unfavorable, but Keri believes that appropriate debt levels can facilitate growth, especially in industries like fintech, insurance, and real estate. She emphasizes that adding debt responsibly can lead to sustainable development for nascent companies, promoting a balanced financial ecosystem.

Asset-Backed Financing: A Viable Venture Strategy

Exploring Diverse Financing Methods

Keri elaborates on asset-backed financing, discussing its potential in various sectors. Tacora Capital has evaluated projects in energy, nuclear space, and equipment financing. However, Keri notes that while such assets offer excellent collateral, they bring challenges, particularly in appraisal accuracy, which can complicate funding deals. Despite these hurdles, Tacora remains committed to exploring these opportunities, recognizing the significant role diverse asset classes play in the financial stability and growth of businesses.

Continuous Learning: Staying Ahead in Venture Capital

Keri’s Reading List

Keri underscores the importance of continuous learning for staying relevant in the ever-changing finance sector. She routinely reads 10-Ks and 10-Qs from fintech enterprises, quarterly letters from other funds, and books like "Witness to the Prosecution" and Michael Lewis’ work on Sam Bankman-Fried. This habit not only helps her stay updated but also provides insights into market trends and regulatory shifts, enabling informed decision-making at Tekora Capital.

Notable Quotes from the Guest

"I hope that over time, we have a handful of success stories in the Tekora portfolio and that the venture ecosystem becomes more comfortable with asset-based financing."

"Reading about different financial cases and situations helps me understand the broader market and make better investment choices."

Fun Facts or Interesting Tidbits

Keri's first job in finance was in ABS CDO Research at just 22 years old.

Keri’s inspiration for her investment thesis came from her experiences with SoFi’s unique student loan challenges.

Despite her interest in finance books, Keri didn’t finish "Bad Blood" because the story felt more like fiction than a real-life account.

Episode Resource: Learning, Reading, and Listening

In the episode, Keri Findley shared various resources she is currently learning from, reading, or listening to. Here are those resources:

Books

Witness to the Prosecution

A book about Michael Milken, detailing his indictment and jail sentence.

Michael Lewis Book about Sam Bankman-Fried

A new book by Michael Lewis focusing on Sam Bankman-Fried.

Bad Blood: Secrets and Lies in a Silicon Valley Startup

A book about the rise and fall of Theranos and its founder, Elizabeth Holmes.

Documents

10-K and 10-Q Filings

SEC filings that provide comprehensive summaries of a company's financial performance. SEC Filings

Quarterly Letters from Other Funds

Periodic updates provided by investment funds detailing their performance, strategy, and outlook. Berkshire Hathaway Shareholder Letters

These resources give insights into various aspects of finance, investments, and notable financial events, which can be highly beneficial for anyone interested in the field of venture capital or financial services.

Featured Guest Bio

Keri Findley, is the founder of Tacora Capital, an Austin, Texas based firm which does asset-backed private credit to venture-owned companies. Providing loans to youngish companies is an important part of the VC ecosystem, and Keri takes pride in helping young entrepreneurs grow their startups.

Email: [email protected]

Fund Information

Tacora creates opportunity in the “white space” among venture capital, private credit, and special opportunities by developing custom financing solutions with a combination of equity, debt, and other tools to help tech-enabled companies grow their assets.

Support The Podcast

If you enjoyed this episode, subscribe to the Female VC Lab Podcast for more insights from leading female investors shaping the future of venture capital. Share this episode with someone who would benefit from their impactful stories and vision.

Got thoughts on this episode? Hit reply and let me know! I’d love to hear from you. 💌

Best,

Barbara

Reply