- Female VC Lab

- Posts

- Milken Conference: A New Game Plan: A Reset for Venture Capital, Innovation, and Entrepreneurship in 2023

Milken Conference: A New Game Plan: A Reset for Venture Capital, Innovation, and Entrepreneurship in 2023

Moderator: Jamie W. Montgomery Co-Founder and Managing Partner, March Capital March Capital, Santa Monica, USA

Ibrahim Ajami, Head of Ventures, Mubadala Capital at Mubadala Investment Company

Anu Duggal, Founding Partner, Female Founders Fund at Female Founders Fund

Raj Ganguly, Co-Founder and Co-CEO, B Capital Group, at B Capital

Arif Janmohamed, Senior Partner, Lightspeed Venture Partners, at Lightspeed Venture Partners

Lo Toney, Founding Managing Partner, Plexo Capital, at Lo_Toney

Q1: Where is the money in venture?

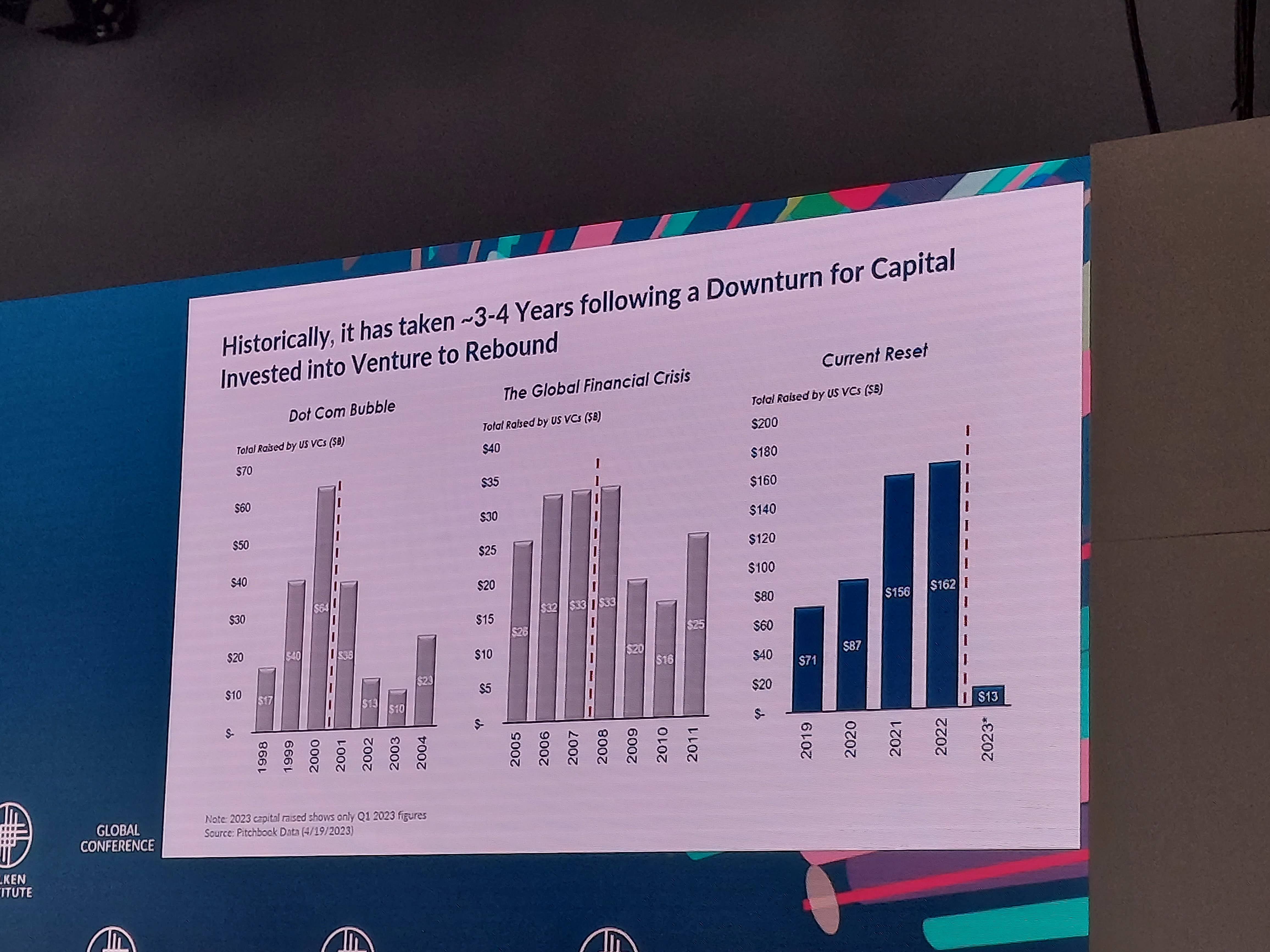

Recently, there has been a significant decrease in the valuations of companies across different industries. This dip in valuations can be attributed to a variety of factors, including shifts in consumer behavior, changes in government regulations and policies, and the impact of global events such as the COVID-19 pandemic. It is important for companies to pay close attention to these changes and adapt their strategies accordingly. In order to remain competitive and maintain a strong presence in the market, companies may need to re-evaluate their business models, explore new revenue streams, and invest in technologies that can improve efficiency and productivity. By doing so, they can not only weather the current economic climate, but also position themselves for long-term success.

For Fund Managers Raising Money:

The current state of the LP markets is that they are frozen, which means that there is a lack of liquidity as well as a general unwillingness to trade. This can be attributed to several factors such as the recent financial crisis, the uncertainty surrounding global politics, and the fluctuating demand for certain securities. It is important to note that this situation is not unique to LP markets and can also be observed in other financial markets as well.

Raj Ganguly, Co-Founder and Co-CEO, B Capital Group, at B Capital

In today's business world, raising capital has become increasingly difficult. Many entrepreneurs have found that it is now 50% tougher to raise capital than it was in the past. This means that startups and small businesses must be prepared to work harder and smarter to secure funding. One key strategy for success is to build strong relationships with investors and lenders. Another is to focus on creating a solid business plan that clearly outlines the company's goals, strategies, and financial projections. By presenting a compelling case for investment, businesses can increase their chances of securing the funding they need to succeed in today's competitive market.

An interesting topic to explore is the evolution of venture capital and how it has changed over the years. Venture capital used to be a relatively small and exclusive industry, with a limited number of firms and relatively high barriers to entry. However, in recent years, the industry has grown significantly, with more firms entering the market and more money being invested in startups. Additionally, the types of investments that venture capitalists are making have changed, with a focus on technology and innovation. This has led to the emergence of new industries and the development of new technologies that have transformed the way we live and work.

One factor driving the growth of the venture capital industry is the increasing availability of capital. Investors are looking for ways to diversify their portfolios and generate higher returns, and many are turning to venture capital as a way to achieve these goals. This has led to an influx of new money into the industry, which has in turn fueled the growth of new firms and the expansion of existing ones.

Another factor driving the evolution of venture capital is the changing nature of innovation. In the past, most innovation was focused on tangible products and physical technologies. However, with the rise of the internet and other digital technologies, innovation has become much more focused on software and other intangible products. This has created new opportunities for venture capitalists to invest in startups that are developing cutting-edge technologies that have the potential to disrupt entire industries.

Overall, the evolution of venture capital is a fascinating topic that is worth exploring in more detail. By understanding how this industry has changed over time, we can gain valuable insights into the forces that are driving innovation and shaping the future of our economy.

Ibrahim Ajami, Head of Ventures, Mubadala Capital at Mubadala Investment Company

The venture capital industry is rapidly evolving, with new trends and strategies emerging every year. As technology continues to advance, venture capitalists are constantly searching for innovative startups and entrepreneurs that can help shape the future. From biotech and fintech to artificial intelligence and robotics, the possibilities are endless. In addition, the rise of impact investing has opened up a new avenue for venture capitalists to not only generate profits but also make a positive social and environmental impact. Despite the challenges and risks involved, the potential rewards of investing in the right startup can be significant, both for the investor and the broader society.

Q2: How do you find GPs, Emerging Managers? What is your criteria?

Lo Toney, Founding Managing Partner at Plexo Capital

Plexo capital and other limited partners (LPs) are constantly on the lookout for exceptional investment opportunities. Just as general partners (GPs) are searching for outlier investments, LPs like Plexo Capital have invested in a total of 53 funds thus far to diversify their portfolios and maximize their chances of discovering the next big thing. As they continue their search for the most promising investments, they are always open to hearing new pitches and exploring innovative ideas that could represent significant growth opportunities for their investors.

Some of the way we determine criteria is by asking: What is the GP’s Superpower?

An example of this is Female Founders Fund, who is on this panel. Here's what make's them different:

Any company lead by a female, they see. They have enough brand recognition so that they are sought after by female startups.

Works the downstream. They speak with other VCs that are at the Series A, B, C so that their companies can be seen by the next round of funding.

Punch above her weight: Position firm well, resource efficient.

Built a brand in the marketplace

Q3: Why Venture?

Arif Janmohamed, Senior Partner, Lightspeed Venture Partners at Lightspeed Venture Partners

We are currently searching for fund managers who are outstanding in their field. Our goal is to find those who have consistently outperformed the market, even during times of economic uncertainty. We believe that these managers can provide our clients with the best returns on their investments. In order to find these outliers, we will be conducting extensive research and analysis, both quantitative and qualitative. Our team will be examining various data points, including historical performance, risk management strategies, and market trends. Additionally, we will be conducting in-depth interviews and due diligence on the managers themselves, to gain a better understanding of their investment philosophy and approach. We are confident that our thorough process will enable us to identify the best of the best, and provide our clients with an exceptional investment experience.

Innovation knows no boundaries, and as such, cutting-edge ideas emerge from every corner of the world. The diversity of cultures, backgrounds, and experiences that different regions offer create a fertile ground for innovation to take root and flourish. That is why, when looking for the next wave of game-changing ideas, it is essential to cast a wide net and search for founders who are making an impact on a global scale. By embracing a global perspective, we can tap into the collective intelligence and creativity of the world's most innovative minds and unlock a whole new realm of possibilities.

Portfolio Construction

When creating a portfolio, it is important to consider what type of portfolio you want to create. Two options to consider are a concentrated portfolio and a diversified portfolio.

A concentrated portfolio is one in which you invest in a small number of assets, typically between 10-20. The idea behind a concentrated portfolio is that you choose these assets carefully, with the expectation that they will perform well and generate high returns. However, this strategy can be risky because if one of the assets performs poorly, it can have a significant impact on your overall portfolio.

On the other hand, a diversified portfolio is one in which you invest in a wide range of assets, typically across different sectors and industries. The idea behind a diversified portfolio is that if one asset performs poorly, it will not have a significant impact on your overall portfolio. Instead, the other assets in your portfolio may perform well and offset any losses.

When deciding what type of portfolio to create, it is important to consider your investment goals, risk tolerance, and time horizon. A concentrated portfolio may be appropriate for more experienced investors with a higher risk tolerance, while a diversified portfolio may be more appropriate for those who are new to investing or who want to minimize risk.

Working with Founders

When it comes to selecting companies and founders, there are several important factors to consider. First of all, it's important to look at the market that the company is operating in. Is it a growing market, or is it a saturated market with a lot of competition? Secondly, it's important to consider the experience and track record of the founders. Have they successfully launched and grown companies in the past? Do they have a deep understanding of the market and the needs of their customers? Additionally, it's important to look at the company's financials and projections. Are they on track to meet their revenue and growth targets? Do they have a solid plan in place for managing their cash flow and expenses? Finally, it's important to consider the overall mission and values of the company. Are they aligned with your own values and vision for the future? By taking all of these factors into account, you can make a more informed decision when selecting companies and founders to work with.

Q4: Clear on who they are as a venture capital fund manager?

Ibrahim Ajami, Head of Ventures, Mubadala Capital at Mubadala Investment Company

How good are they as money managers? They need precision and clarity. 10x to 20x returns are probably not realistic in current times (2023).

Venture Capital Fund Managers are responsible for sourcing, vetting, and managing investments in promising startup companies. They work closely with entrepreneurs and other stakeholders to identify opportunities for growth and profitability.

In addition to these core responsibilities, Venture Capital Fund Managers also play a crucial role in providing strategic guidance and operational support to portfolio companies. This may involve helping startups develop their business plans, identifying and recruiting key talent, and providing access to industry networks and resources.

Moreover, Venture Capital Fund Managers must be skilled at managing risk and making informed investment decisions in a fast-paced, constantly evolving market. They must stay up-to-date on the latest trends and developments in their industry, and have a deep understanding of the companies and markets in which they invest.

Ultimately, the success of a Venture Capital Fund Manager depends on their ability to identify and support high-potential startups, navigate complex market dynamics, and deliver strong returns for their investors. It is a challenging and rewarding career path for those with a passion for entrepreneurship and a desire to make a meaningful impact on the startup ecosystem.

Reply